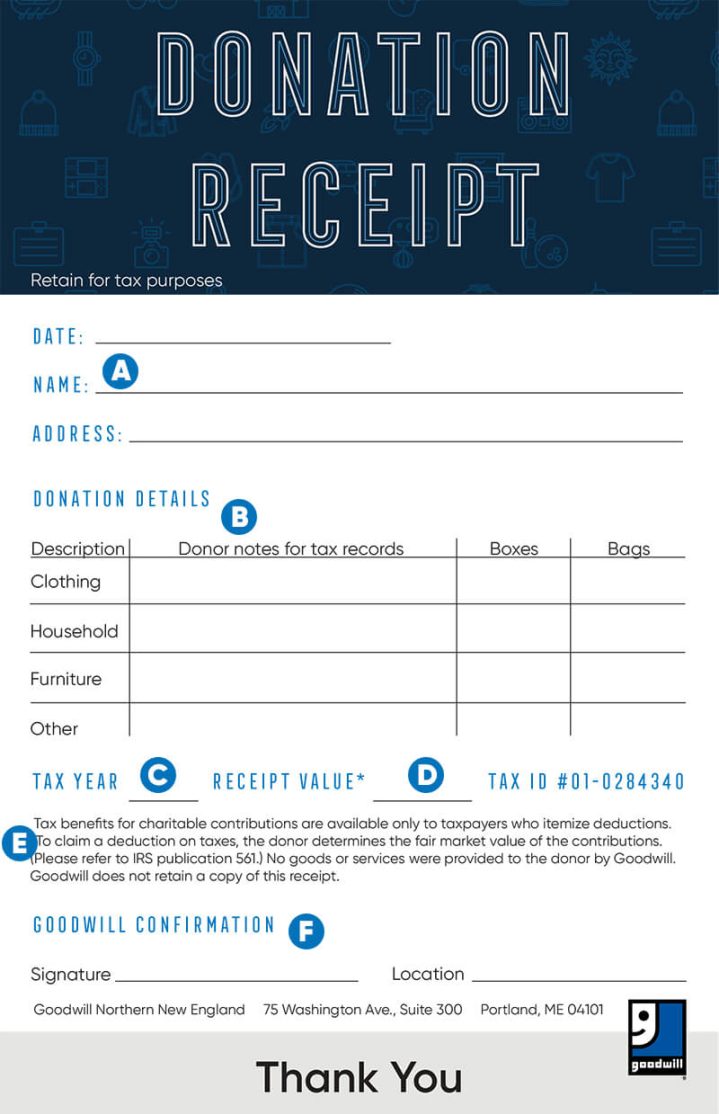

How to fill out a Goodwill Donation Tax Receipt

Did you make a tax-deductible donation to Goodwill and need to fill out a tax receipt? This step-by-step guide will help you fill out the donation tax receipt and get things in order for tax season.

This form is available at the time of donation from our stores and donation centers in Maine, New Hampshire and Vermont. Or, simply request a donation receipt online here. To learn how to deduct your donations from your taxes, please scroll to the bottom of this page for a how-to video guide.

A: Date, Name and Address

This section organizes when a donation was made, who dropped off the donation and your current address.

B: Donation Details

Use this area to write in a brief summary of items donated & the number of boxes and bags. The “Other” section can be used to describe items that are not clothing, household or furniture. Examples: computer equipment or automobiles.

C: Tax Year

Write in the year the donation was made.

D: Tax Receipt Value

Write in the total fair market value of your donation. This value is determined by you, the donor. Goodwill provides a donation value guide to help determine fair market value. Please note: Goodwill employees cannot help determine fair market value.

Please refer to IRS publication 561 for information determining the value of donated property.

E: Fine Print

This sections states:

- Tax benefits are available to taxpayers that itemize deductions

- The donor determines the fair market value of an item

- Goods or services were not provided in exchange for the donation

- Goodwill DOES NOT retain a copy of the tax receipt

F: Goodwill Confirmation

Paper tax receipts need to be signed by the employee that accepted the donation.

How to deduct your Goodwill donations on your taxes

All your donations to Goodwill NNE are tax deductible. In this video, we’ll teach you how to write off your noncash donations such as clothing, books, shoes and other items you donated to Goodwill this year.